Although the term “spaving” may be relatively new, the idea behind it has been practiced in retail since the beginning. It has only grown more popular now as consumers look for more tempting deals and savings benefits whenever they shop for any type of product. It all comes down to the perception of value and long-term savings.

Savvy retailers can leverage this type of emotional spending through a variety of promotional deals and sale alerts in order to benefit immediately and due to long-term customer loyalty.

What is spaving?

This trendy retail term—spaving—is a combination of the two words “spending” and “saving.” Basically, it’s the concept of a shopper spending more in order to save more money. It’s a clever way for retailers to capitalize on the consumer behaviors of expenditure and thriftiness. People end up spending more simply because they feel like they are saving more at the same time. It’s a very common marketing technique that both off-line and online retailers can use.

Common examples of spending more to save more:

- Bulk purchases – Buying items in larger quantities to receive a discount per unit. The customer gets additional items and therefore spends more upfront.

- Membership programs – People who pay a monthly or yearly charge to become a member often receive a percent discount or extra items free on some purchases.

- Upgrade for savings – Classic upsell techniques let people buy high-priced product options for a slight savings even though they are spending more upfront.

- Bundled offers – Purchasing product bundles that offer a lower combined price than buying the items individually means the retailer gets more upfront.

- Free shipping deals – Many online retailers have minimum purchase requirements in order to get free shipping. This encourages people to add items to their shopping list.

The psychology behind spaving and customer spending

It isn’t difficult to understand that shoppers want good deals. They want to spend less in general, and most are savvy enough to understand that an initial higher investment can reap rewards down the road. Spaving taps into a host of cognitive biases in behavioral tendencies associated with the perception of value. Spending more now to save more later is generally a smart financial strategy. They get the immediate gratification of securing a deal and the satisfaction of feeling like a smart shopper.

When you look at the psychology from the pain point prevention or avoidance side of things, spaving still works. Shoppers have a negative emotional reaction from spending too much or feeling like they were cheated out of a limited-time sale or bonus item opportunity. This is why people sign up for lists to get deal notifications and search for coupon codes before making online purchases. Social proof and marketing influences only amplify these feelings.

How can a retailer encourage spaving and impulse purchases?

Multiple strategies exist when it comes to encouraging spending more to save more. Although the mechanics of making special offers, upselling and cross-selling, and attractive bundling deals differ, it all comes down to convincing people that they make out better in the long run.

The simplest approach involves special offers like the classic “buy one get one free” or get a certain percentage off if they spend a total amount of money. Things like paid membership or loyalty programs also fall under this umbrella. By investing a bit, the shopper saves money.

Upselling and cross-selling have their place in the world of spaving, too. In these cases, the value comes from better or additional products that give the buyer something besides a monetary benefit. Instead, they save time, enjoy added convenience, or get other rewards due to a product’s features.

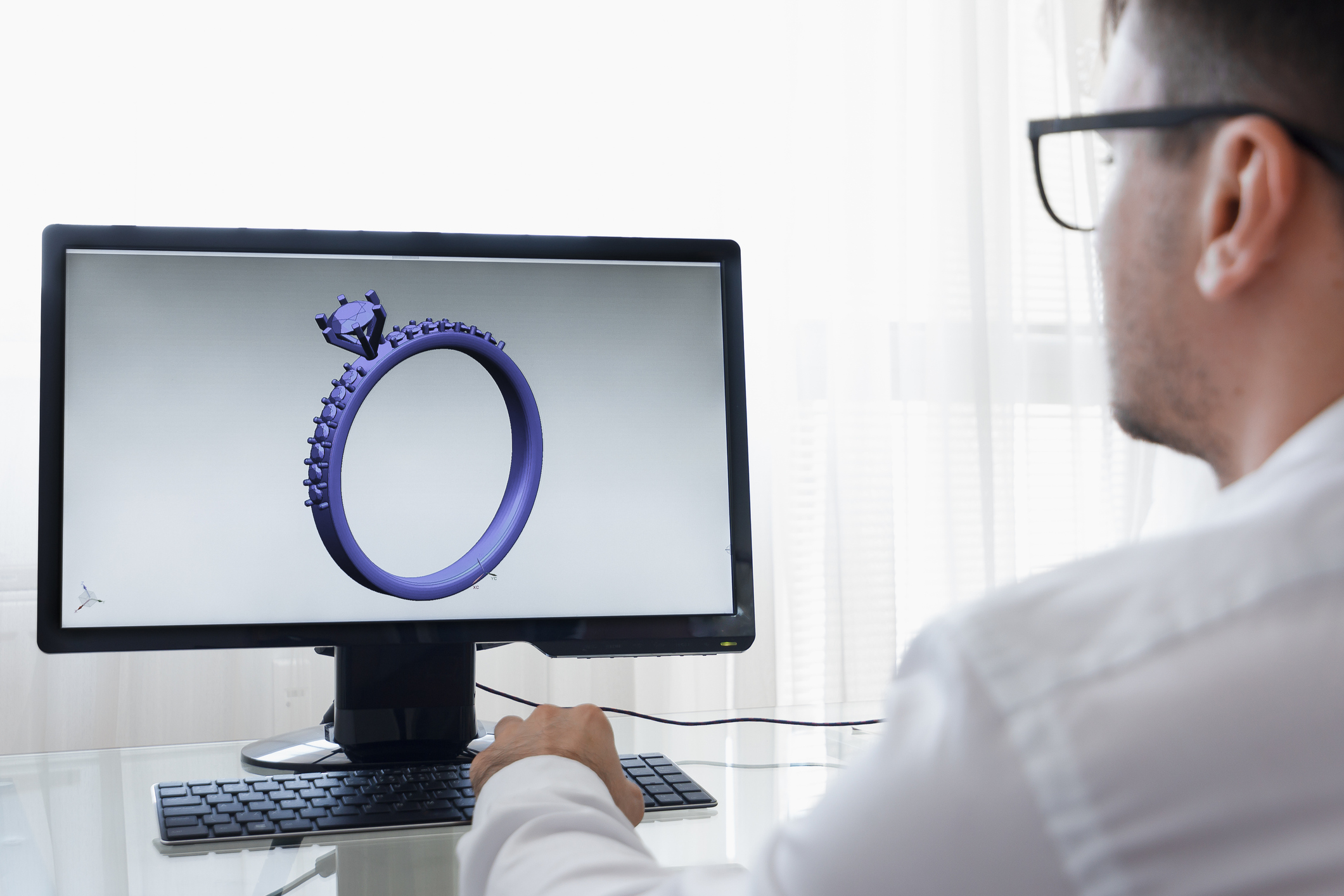

Bundling combines these two methods of encouragement into one. Why wouldn’t a person interested in buying a gold necklace say no when presented with a necklace and bracelet set that reduces the cost of the individual products? This works well for any market or niche. A shopper will buy a high-end furniture set to save on the whole room rather than by an individual couch. Another will gladly spend more on a laptop that comes with a quality headset then they would on one that does not.

It all starts with knowing your audience’s spending habits and buying patterns

No matter what, you need to know what your target audience wants and expects before you start any marketing or special deal efforts associated with spaving. It makes sense to assume that most people want to save money. This is true for both consumers with less extra money and those who pride themselves on savvy investments in luxury products. Knowing the individual always helps more. If you have data on hand from a smart customer relationship platform like Clientbook, you can make highly affected offers that resonate with the individual.

Create a sense of urgency and feed the emotional needed to save

Always work with the psychology behind this trend. These powerful techniques drive consumer behavior and encourage immediate action. Retailers can invoke urgency through limited time offers, countdown timers, or low stock notifications. For example, consider the draw of a jewelry bundle that includes a high-quality piece with only 100 left. When you emphasize that the particular deal or discount is available for only a short amount of time, you also tap into the fear of missing out (FOMO). Combine this type of social benefit with savings, and you have a recipe for quick and enthusiastic sales.

Conclusion

Retailers can leverage this emotional power to make customers feel special and valued. Spaving is never about the hard sell or pushing people to spend more than they really want to. Instead, it’s about highlighting real benefits for them that resonate with their desire to make smart financial decisions without giving up their shopping habits. Everyone wins in the end.

.jpg)